What Could Lie Ahead for Senior Living & Care in 2024

What Could Lie Ahead for Senior Living & Care in 2024

This blog is based on a webinar presented in January 2024 by Stephen M. Taylor, CPA, MBA, Senior Principal with CliftonLarsonAllen LLP. The information has been provided for general information purposes only.

As the senior living industry steps into 2024, the business landscape is transforming—driven by a range of factors, from demographic shifts to policy updates. To thrive, companies should recognize the unique challenges this year brings, while planning to overcome obstacles and take advantage of market conditions.

Setting the stage: What’s going on in the Senior Living industry

While median occupancy rates across the country have largely recovered from COVID decline, increasing to 80%, median operating margins are decreasing—especially in skilled nursing. Even with occupancy momentum, skilled nursing facilities are facing negative margins, with or without COVID funding.

In addition, the skilled nursing industry is closely watching the potential ripple effects of the Centers for Medicare and Medicaid Services’ (CMS) proposed minimum staffing requirements. Providers must prepare for potential changes and assess their financial implications, especially in rural areas.

For assisted living, rent income continues to rise and more affluent residents are joining the roster, but costs and expense pressures are rising as well.

And with no surprise, workforce remains the number one industry challenge. Senior living continues to lag behind other healthcare segments in staff hiring and retention. Additionally, aggressive workforce expenses continue squeezing margins.

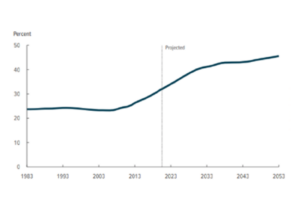

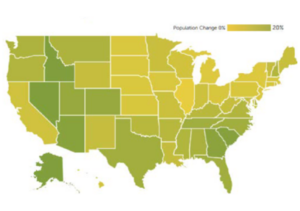

Yet, within this landscape, the 65+ population is growing. The percentage of people aged 65 or older, relative to the number of people ages 25 to 64, is projected to rise from 34% in 2023 to 46% in 2053. As companies look at strategies for the next five years, it’s important to note that between now and 2028, the 85+ population will grow by more than 600,000 people.

Population Age 65 or Older as a Share of the Population Ages 25 to 64

85+ Population Growth from 2022 to 2028

Strategy and planning: How to combat shrinking profit margins

To stay current and profitable, senior care companies should consider:

- Workforce enhancement:

- Providers should explore innovative strategies to attract and retain skilled professionals in the face of a competitive labor market.

- Digital integration:

- Companies should invest in technology to navigate a complex landscape, enhancing operational efficiency, improving resident care, and staying ahead of industry trends.

- Diversification of services lines:

- The new era of consumers is focused on wellness and solutions. There is an increased emphasis on improving and maintaining health and lifestyle. Senior care operators can find opportunities to elevate their value proposition in this market, capturing more of the health care and wellness economy. This may require innovation, strategic partnerships, embracing alternative payment models, and investment of capital and talent.

- Unlikely partnerships:

- The number of solutions available to prevent and treat ailments is increasing at an exponential rate; however, our healthcare system is fragmented and the sheer volume of options is overwhelming. This environment creates an opportunity to join forces with other businesses, non-profits, and government organizations to provide coordinated solutions to consumers. Ask yourself: Could a partnership with another entity to tackle a healthcare issue lead to growth and opportunity?

- Using Medicare Advantage (MA) to your advantage:

- As of 2022, over 28 million individuals had chosen an MA plan, accounting for almost half (48%) of eligible Medicare beneficiaries, and this growth trend is projected to continue. It’s worth providers asking:

- How will we align with MA, and by aligning does it shift the value proposition?

- How will we tap into MA and develop economic sharing with plans? Is there a way to share in costs and share in rewards, such as programs to increase nurse staffing or reduce hospital stays?

- As of 2022, over 28 million individuals had chosen an MA plan, accounting for almost half (48%) of eligible Medicare beneficiaries, and this growth trend is projected to continue. It’s worth providers asking:

- Reimbursement optimization and tax incentives:

- Companies should optimize reimbursement strategies and consider changes in policies to support those strategies. Leveraging available tax incentives can positively impact the bottom line as well.

- Business transfer with baby boomers:

- With a significant business transfer underway with the baby-boomer generation, owners and operators must execute effective plans across various stages of their business life cycle. Succession planning and adapting to evolving market demands are critical considerations.

- Capital markets and M&A activity:

- The industry is witnessing significant merger and acquisition activity. Companies should stay attuned to these changes, understanding how market consolidation may impact competition, service quality, and overall industry dynamics.

Economic factors such as inflation and interest rates, alongside operational challenges like regulatory compliance and staffing, pose headwinds. However, tailwinds include technological advancements and evolving care models that can lead to competitive advantage. Providers who proactively embrace change, leverage technology, and adopt innovative strategies will be well-positioned to thrive in this dynamic landscape.

For more information, please visit the on-demand webinar here.