Getting Complaints from Residents & Families about Their Pharmacy Bills?

It’s that time of the year again…the dreaded Medicare Part D “Donut Hole,” where beneficiaries often face temporarily higher costs for prescription medications.

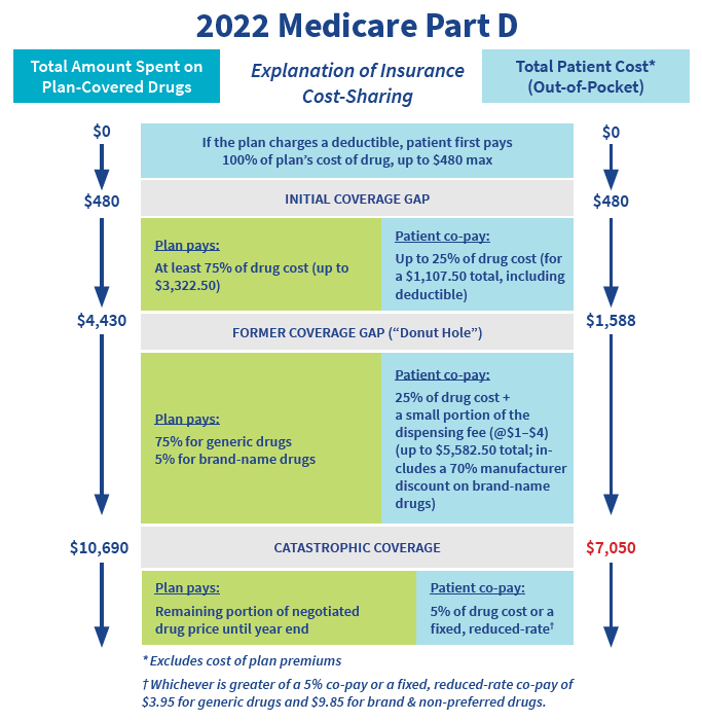

Although the “coverage gap” (commonly known as the Donut Hole) has been officially eliminated, residents still may face increased medication costs and co-pays once they complete the initial coverage phase, having spent a total of $1,588 out of pocket.

The good news is that although residents’ co-pays may go up somewhat during this phase, these costs should be lower than in previous years.

And what about the argument that retail or mail-order pharmacies are cheaper than your contracted long-term care (LTC) pharmacy? Well, the fact is that LTC pharmacies — usually excluded by insurance companies’ pharmacy benefit managers from being considered “preferred” (thus offering lower co-pays) — provide many more dispensing, reimbursement, and clinical services specifically geared to improve outcomes in senior and residential care.

What’s more, the slightly higher out-of-pocket costs for LTC pharmacy dispensing can help residents reach  better coverage levels faster by getting their expenses to the annual max earlier. Once that limit is reached, co-pays are reduced drastically for remaining medication fills for the year. Since the annual maximum is the same for all beneficiaries, the sooner it can be reached, the sooner co-pays decrease to only 5% of the drug cost or a fixed amount of $4.15 for generics and $10.35 for branded and “non-preferred” drugs.

better coverage levels faster by getting their expenses to the annual max earlier. Once that limit is reached, co-pays are reduced drastically for remaining medication fills for the year. Since the annual maximum is the same for all beneficiaries, the sooner it can be reached, the sooner co-pays decrease to only 5% of the drug cost or a fixed amount of $4.15 for generics and $10.35 for branded and “non-preferred” drugs.

To learn more about the difference between LTC pharmacies and retail or mail order pharmacies, download our quick guide, Understanding Medicare Part D: “Preferred” vs “Contracted” Pharmacies.